Investment Management

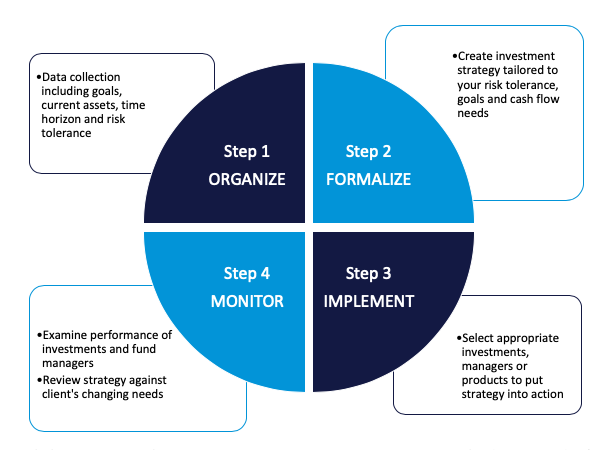

Managing wealth in today’s ever-changing financial environment requires a long-term commitment with a prudent investment strategy. In our current world of complex financial issues, it requires more data, time and expertise than most people have to manage their own assets diligently. Our Managed Assets team supports our Financial Advisors and clients by providing data, technology and experience to help create and implement these strategies. The following 4-step process is the basis to a successful investment strategy:

We believe in open architecture to create investment strategies to meet the diverse needs of our clients. We also have access to third party investment managers when additional expertise is needed.